Funding Your Trust and Implementing Your Plan

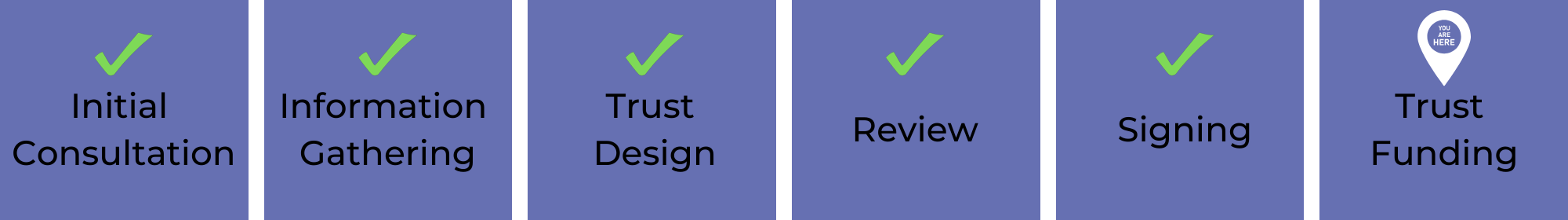

After you have signed your estate plan, you will enter the final - and critically important - phase: Trust Funding and Implementation (not the step you are at? Click Here).

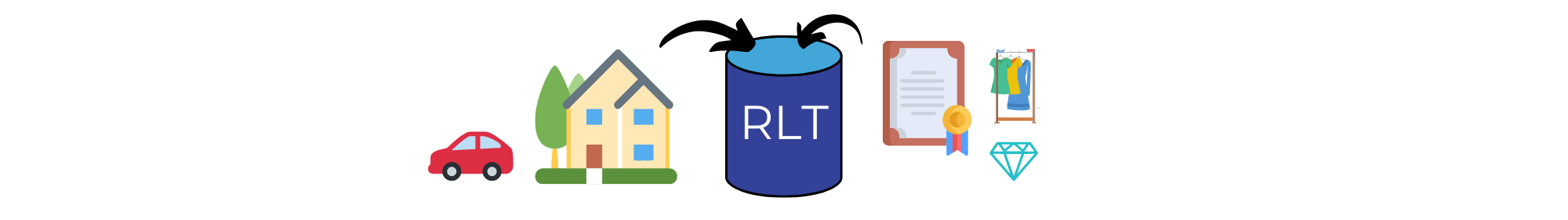

Funding your trust is the final step to achieving the protection and peace of mind that you deserve and that you have worked so hard to reach during the estate planning process. “Funding” your trust is the process of transferring assets from your name as an individual (or as a couple) to you, as trustee of your trust. Not all assets are transferred to your trust, and part of creating a customized plan for you is making a determination how each asset will be owned during your lifetime, and transferred upon your death.

-

As indicated above, funding is the process of transferring your assets from your individual name, to you as trustee of your trust. This allows your successor trustee to step in if you become incapacitated or pass away and manage those assets for you as the successor trustee. Certain assets do not get transferred to your trust, including life insurance, retirement accounts and other assets that transfer by beneficiary designation. This does not mean that these assets are not important to plan for - they are often some of your largest assets - but the plan for those assets needs to be different and align well with your overall plan.

-

Funding is just as unique as the estate plan itself. We may advise you to name your trust as a beneficiary during certain periods of your life, and then name beneficiaries directly later (such as when minor children become legally and financially mature enough to receive an inheritance). We will provide you with guidance and funding instructions. In addition, we prepare and record deeds of real estate, and provide you with the opportunity to include other transfers are part of your estate plan (such as entity transfers and custom beneficiary designations).

We often work with advisors and others to help facilitate transfers, but ultimately, funding is your responsibility other than what we have expressly agreed to complete.

-

It doesn’t have to be. We recommend following our instructions carefully, and completing the funding process right away.

To help you, we have prepared a Funding Video to show you step-by-step what needs to be done, and we remain available to answer questions.

Funding is so important to a complete estate plan. It may take several phone calls, a trip to the bank or some work with your advisors and our firm, but we promise that it is worth it.

-

Yes, you can add assets at any time. While we strongly recommend completing the funding process as soon as you complete your estate plan, it is a reality that your assets will change over time. If you purchase a new house, a rental property or buy or sell cars, change bank accounts or any other changes in assets, we will not only teach you how to easily navigate these changes, but we will be available to assist you with questions.

-

You are done! However, estate planning is not a “set it and forget it” activity. A lot can change with assets, children, marriages and businesses in a short period of time. You should plan to prioritize the review of your estate plan every few years as well as any time there is a major change with your assets, business or family dynamics.