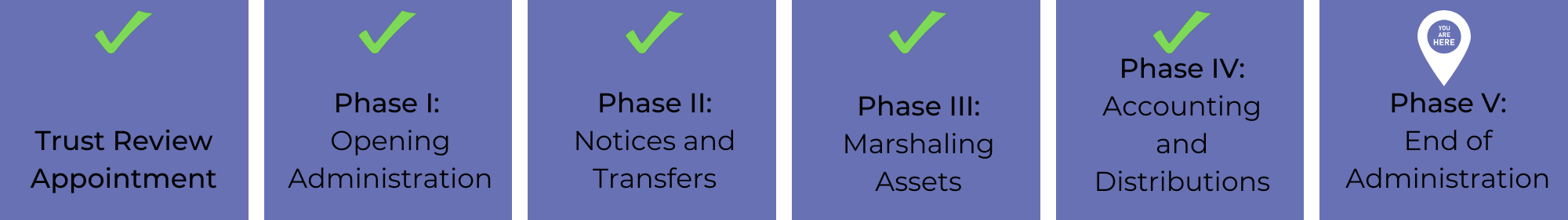

Phase V: End of Administration

The trust administration is concluded by performing the final closing tasks, including distributing tax information and filing a final return, and payment of final fees and costs. Any holdback balance is distributed and the trustee will sign an end of administration documentation confirming that all tasks have been performed.

-

If not previously filed, a final return for the trust should be filed by the accountant for the trust and the accountant’s fees paid. The likelihood for any dispute regarding the matters in the tax return should be carefully evaluated.

-

Once a trust administration is complete, a trustee should retain certain records for specific periods of time for their own protection. We work with our clients to determine what should be kept, in what form, and for how long.

-

Once the trustee is absolutely certain that all final costs have been paid, and no further liabilities are possible, then the final distributions are made.

-

Some attorneys “terminate the trust” and some do not (just in case something comes up). Our approach is to sign a document confirming that all trust administration matters have been completed. The trust administration is closed, but the possibility for opening it back up again is left open in case an asset surfaces later or some other compelling reason comes up.